Cashing Out Crypto: The Privacy Guide for Investors

The world of cryptocurrency has come a long way since its inception. With the rise of Bitcoin and other digital assets, investors have been able to diversify their portfolios and invest in a wide range of assets, from traditional stocks to commodities and even art. However, with this increased investment comes a new set of concerns: privacy.

As more people dive into the world of cryptocurrency, they’re discovering that the anonymity and secrecy offered by digital currencies can be both attractive and intimidating. But what happens when you need to cash out your crypto holdings? Do you have to reveal your identity or risk being tracked?

Why is privacy important for investors?

Investors should prioritize their right to financial security, which includes maintaining confidentiality about their transactions. Here are a few reasons why:

- Regulatory compliance: Governments and regulatory bodies are cracking down on cryptocurrency trading and investment activities. By keeping your holdings private, you’ll avoid potential fines or penalties.

- Security: Cryptocurrency exchanges often have strict identity verification protocols in place to prevent fraud. Being anonymous can make it easier for them to maintain this security.

- Tax obligations: Governments are increasingly cracking down on tax evasion and money laundering related to cryptocurrency transactions.

How to cash out your crypto holdings without revealing your identity

Cashing out your crypto holdings is a common concern for investors, but there are ways to do so while maintaining your anonymity:

- Use a paper wallet or a digital wallet

: Paper wallets provide a physical, tamper-proof record of your private keys. Digital wallets, such as MetaMask, offer more advanced features like multi-sig transactions and secure storage solutions.

- Transfer funds through services: Services like Coinbase, Binance, and Kraken allow you to transfer cryptocurrencies using the same wallet or account that holds them. This method is relatively easy to use and maintain your anonymity while still ensuring your private keys remain private.

- Use a third-party exchange: Third-party exchanges offer a more secure and private alternative to traditional exchanges. These services often require you to verify your identity through documents such as government-issued ID or passport.

Best practices for handling cryptocurrency

To protect your financial security, follow these best practices:

- Use strong passwords and multi-factor authentication: Use unique and complex passwords, and enable two-factor authentication on all accounts.

- Regularly back up your data: Keep backups of your wallet, exchanges, and other digital assets in case something goes wrong.

- Be Cautious with social media and online advertising

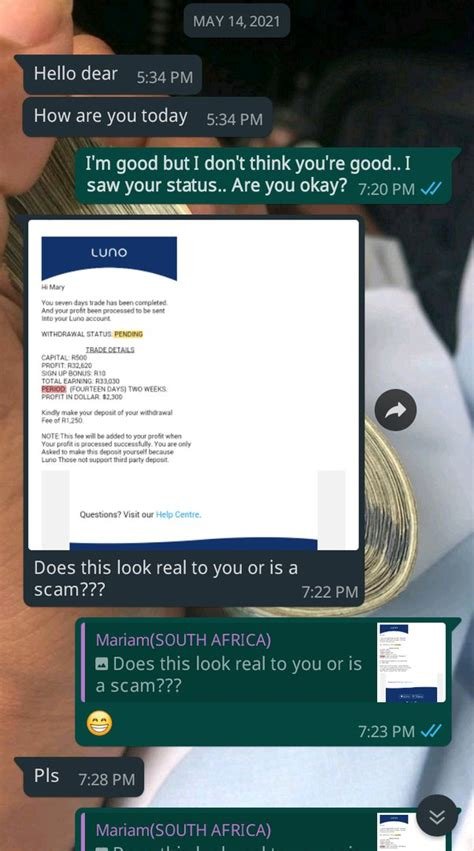

: Be wary of suspicious ads or messages that claim to offer investment opportunities.

Conclusion

While the world of cryptocurrency is often associated with anonymity and secrecy, it’s essential for investors to prioritize their financial security while also respecting government regulations. By understanding how to cash out your crypto holdings without revealing your identity, you can maintain your privacy and peace of mind while still investing in digital assets.